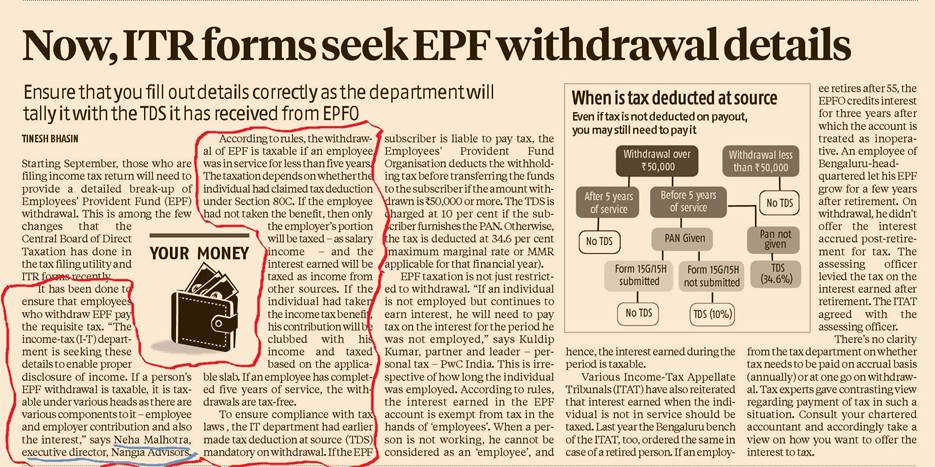

Now, ITR forms seek EPF withdrawal details – Neha Malhotra

Starting September, those who are filing income tax return will need to provide a detailed break-up of Employees’ Provident Fund (EPF) withdrawal. This is among the few changes that the Central Board of Direct Taxation has done in the tax filing utility and ITR forms recently.

1. Neha Malhotra, Executive Director shares her views on aforementioned story for Business Standard